Published

- 3 min read

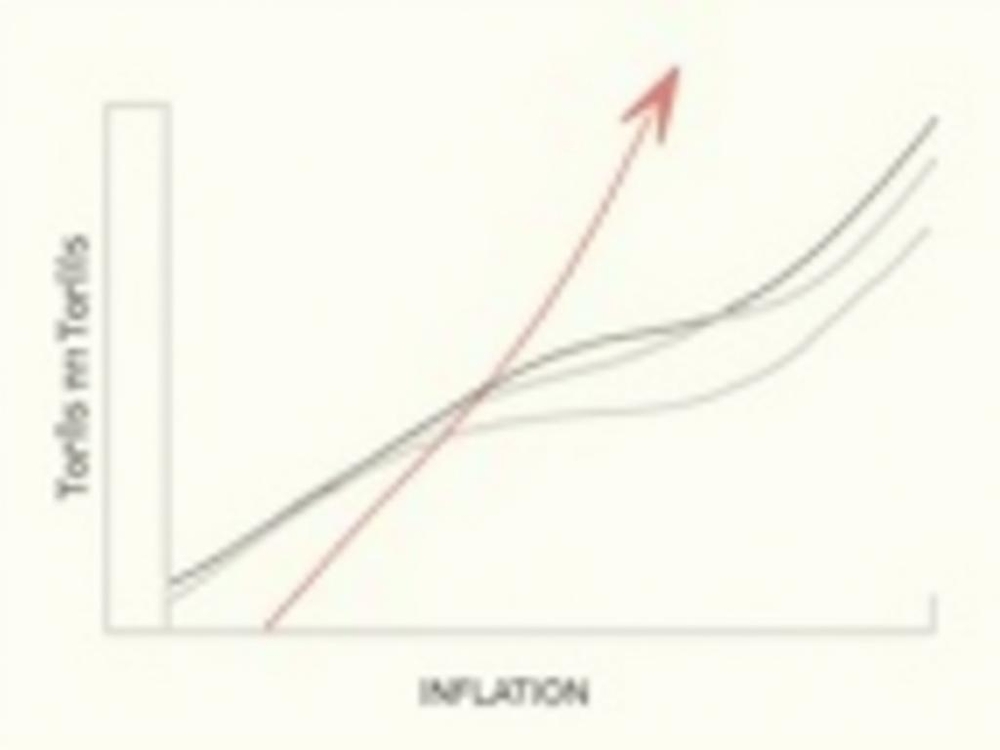

Inflation, Tariffs, and Economic Impact

US Inflation Eases, Offering Some Relief Ahead of Tariffs

Key Points to Consider

US consumer prices rose at the slowest pace in four months in February. This is good news for American families. Many worry about proposed tariffs that might hike up costs.

The consumer price index saw a small increase of 0.2%. This is a slowdown from the 0.5% jump in January. The core measure, excluding food and energy, also went up by 0.2%.

Let’s break this down. We are not just looking at numbers. These are real prices affecting American people daily; at the store, at the gas station, and in monthly bills.

This slowdown comes at a crucial moment. Economists warn that pending tariffs could undo our progress. The stakes are high. Even with this small monthly rise, many families still feel the pinch. They haven’t bounced back fully from the post-pandemic inflation surge.

We have made some headway. This cooling in inflation is an improvement. It’s better than where we were a few months back. This change means a lot for policymakers as they decide on interest rates. These decisions influence mortgage rates and business investments.

This path forward needs care. Our economy has shown surprising resilience. We’ve avoided recession while keeping unemployment low. But managing inflation and growth is a tightrope walk.

Everyone wonders, will this hold? With tariffs possibly on the way, consumers ask if this relief is just for now. The economic impact of trade policies has been big in the past, especially on consumer prices.

Let’s look at some questions.

How do tariffs affect inflation?

Tariffs are taxes on imports. They can increase the price of goods. When tariffs are applied to important goods, these costs often pass on to consumers. This results in higher prices at the store. More expensive consumer goods mean inflation can rise.

For example, if tariffs are placed on raw materials, companies pay more. They might increase prices to offset this extra cost. Over time, these higher prices circulate throughout the economy, contributing to overall inflation.

What is the impact of inflation on consumer prices?

Inflation makes things more expensive over time. When inflation rises, you might see prices go up on everyday items. Groceries, clothes, and utilities might cost more.

For many, this means a tighter budget. People find themselves spending more money just to buy the same things. Saving and investing can become challenging.

As inflation eases, spending power stabilizes. This is why it’s a welcomed change.

Summary

This was about inflation and its recent trend. With potential tariffs, inflation remains a hot topic. It’s crucial to keep watch as this affects us all. Up next, keep your eye on policy discussions and economic updates. These will have a big say in what happens next.