Published

- 4 min read

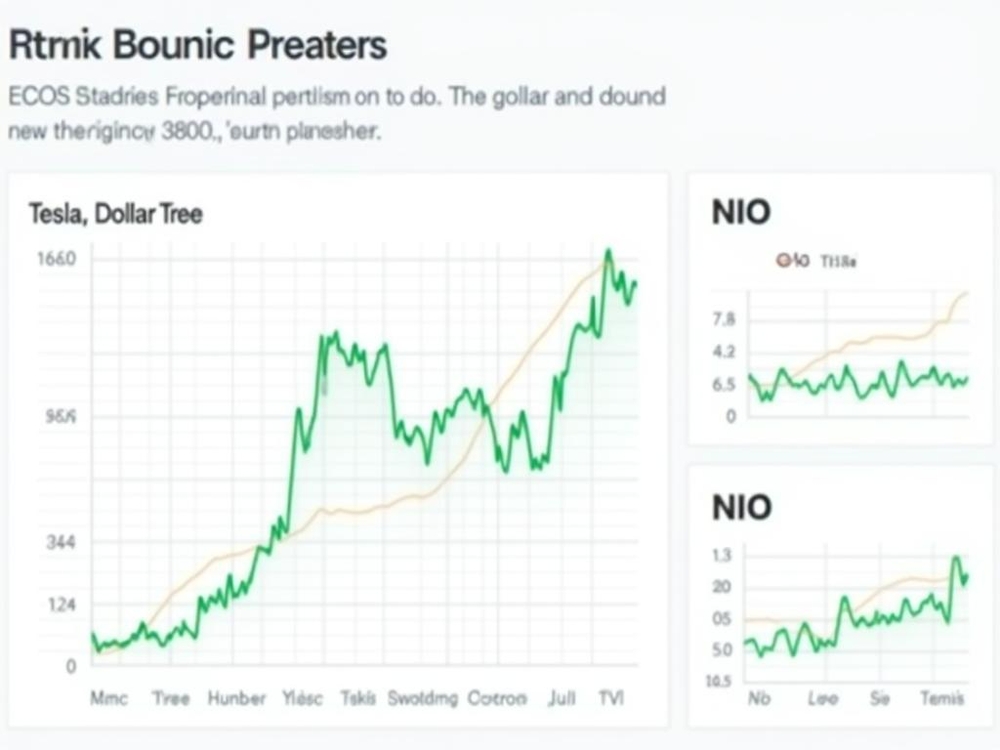

Investing Insights: Tesla, Dollar Tree, and NIO Stocks Explained

Investing.com’s stocks of the week

The uncertainty has once again continued this week, and of course, there was no shortage of big moves. Here are Investing.com’s stocks of the week.

Tesla (NASDAQ:)

Tesla stock was a rollercoaster. It rallied at the start of the week before pulling back. There’s a buzz about the market ending higher. Why? There were rumors that the Trump administration’s trade policies might skip over some tariffs. This led to a 10% jump in Tesla’s stock on Monday. Elon Musk, known for speaking his mind on his social media, noted that the tariffs still hit Tesla hard.

Analysts at Bernstein view it differently. They think these tariffs will mostly hurt Detroit’s automakers. They say Tesla will come out ahead because of its position and market share.

Why is Tesla stock fluctuating?

Tesla’s stock movements often grab attention. It’s not just the trade policies or tariff talks. Tesla operates in a competitive market, with lots of ups and downs. The company’s global strategy involves expanding its manufacturing locations and increasing its electric vehicle footprint. This requires large investments and can lead to volatility. There’s also the impact of global economic conditions on Tesla’s sales and production. When news about trade policies or economic shifts arise, it can cause sharp movements in Tesla’s stock.

Additionally, Elon Musk’s announcements influence Tesla’s stock. His comments on production targets, new product launches, or even interactions with policy decisions can make significant waves. The mix of innovation, competition, and financial speculation keeps Tesla’s stock lively and sometimes unpredictable.

NIO (NYSE:)

NIO is another electric car company worth watching this week. The Chinese EV market adds to the intrigue. In the last week, NIO’s stock dipped over 16%. This happened after they announced a proposal to offer around 118.8 million shares. This equals about 5.4% of their outstanding shares. The offer was priced at HK$29.46 each, a 9.5% discount from the last Hong Kong closing price.

According to the company, the funds will be used for developing smart electric vehicle technology and new products. Macquarie analysts maintained a Neutral stance but noted concerns. They worry about the need for future financing and expect negative free cash flow into FY25E.

How does NIO compete in the EV market?

NIO is one of the major players in the Chinese EV market. They offer a variety of electric vehicles, focusing on smart technology and innovative designs. NIO competes with firms like BYD and XPeng, positioning itself as a premium brand. They have a unique business model, including battery-swapping stations. This innovation provides convenience for drivers, setting them apart from competitors who focus solely on charging networks.

NIO’s approach to marketing and brand loyalty also impresses. They’ve built a strong community around their products, offering services that enhance customer experience. As the EV market grows, NIO’s challenge is balancing growth with profitability. They need to keep ahead in technology and manage costs as competition intensifies.

Dollar Tree (NASDAQ:)

Dollar Tree makes the list after a hefty 11% rise on Thursday, then a 5% retreat on Friday. It’s still likely to end the week on a high. This jump follows results that surpassed earnings expectations. The bigger news, though, is their decision to sell Family Dollar to two private equity firms for $1 billion.

UBS kept a Buy rating. They highlight that selling Family Dollar is a game-changer for Dollar Tree. This move may boost shareholder value, even with tariff uncertainties. They’re optimistic that this will improve returns on capital and earnings. The message? Sometimes, doing less leads to more.

What does Dollar Tree’s sale mean for investors?

Selling Family Dollar could be a strategic win for Dollar Tree. By offloading this part of the business, Dollar Tree might streamline operations and focus on its core business. Family Dollar faced challenges, impacting Dollar Tree’s overall performance. Investors might see this sale as a step towards better profitability and focus.

With this sale, Dollar Tree can reinvest in its primary stores, potentially boosting overall efficiency. Investors might view this decision as an opportunity for the company to stabilize and grow stronger. This strategic choice might present a more compelling investment case moving forward.

Summary

This week covered Tesla, NIO, and Dollar Tree stocks. Tesla’s stock saw fluctuations due to trade policy rumors. NIO announced a big share offering amidst its market challenges in China. Dollar Tree decided to sell Family Dollar, aiming for better returns. For investors, understanding these shifts can guide portfolio decisions. Watch these companies as they navigate their respective markets.